FOUNDATION

Business Literacy We Wish Someone Would’ve Taught Us In School

March 6, 2021 | Education

Billionaire Richard Branson shares this story from time to time.

He was in a meeting with his top executives who shared some important figures about how the company was doing. At this point, his business was already hugely successful. In fact, it was his 50th birthday, almost 34 years after he founded Virgin.

He looked over the numbers and asked “Is that good news or bad news?”

Perplexed, one of the executives pulled him aside to say, “Listen, I don’t think you understand the difference between “net” and “gross.” Let me explain it to you.”

Branson describes, “He colored in this piece of paper blue, and then he put a net — a fishing net — amongst it. And he put little fish in the fishing net,”

“The fish in the net are your profit. And all the fish that are not on the net are your gross turnover,” the executive told him.

After founding one of the most successful brands in the world, Richard Branson still needed help with the basics.

It can be easy to get quite far into your entrepreneurial journey without understanding some of the business and financial terminology and concepts that your suppliers, customers, and peers are using with familiarity.

And while the prevailing theory is that no education is ever a waste of time or money, it might have been nice if they had taken just a couple of hours from dissecting Midsummer Night’s Dream when we were 15 to go over profit-and-loss accounts, forecasting, cash flows, and basic taxes.

Profit and Loss Statement or Income Statement

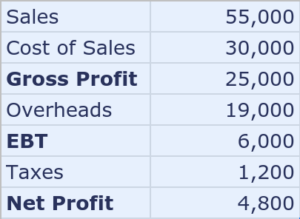

A profit and loss statement, income statement, or earnings statement summarizes your sales, costs, and expenses over a specific period.

Information from these records shows how profitable your company is, and whether you could increase profits, either by increasing revenue or reducing costs, or both. It’s a way to quickly grasp the full picture of your profitability.

The Profit and Loss statement is one of three reports every public company releases, along with the balance sheet and cash flow statement.

It can be done monthly, quarterly, or annually.

Here’s what you need to include.

Sales — This is the sum of the money you bring in from all of your sales.

↓

Cost of Sales — The cost of sales is how much the product(s) you sell cost you. Things like your materials, wholesale costs, or the cost of labor to create goods. This is different from overheads because these costs go up and down with your sales. It’s sometimes called direct costs or cost of goods sold.

↓

Gross Profits / Revenue — Your gross profit is how much you make after deducting the costs associated with making and selling your product(s).

↓

Overheads — Your overheads are the fixed costs you have to pay, no matter how much you sell. Things like rent, utilities, insurance, and office supplies. It is sometimes referred to as fixed costs, indirect costs, or operating expenditure (OPEX)

↓

EBT — Earnings before tax is how much profit you have made after your cost of sales and your fixed costs but before accounting for taxes. You might also see EBIT, which excludes both taxes and interest payments.

↓

Net Profits / Income —Your net profit is the amount of money that is left after you deduct your total business expenses

A simplified balance income statement could look something like this

Dividends are payments you might take out of your business for yourself or your shareholders to share profits. These payments aren’t reflected in your overheads or costs and will come after net profits in your reporting.

How is a Balance Sheet Different?

Your second report will be a balance sheet.

While your income statement summarizes sales and expenditure to show you your profit or loss, the balance sheet shows all of your assets, liabilities, and equity.

It’s everything you owe and own, as well as the amount invested by shareholders.

The idea behind the balance sheet is that your total assets and your total liabilities are always equal. This makes sense because your company has to pay for everything it owns, either by taking out loans or from money that you or your shareholders have invested.

It’s a snapshot of where your business is at the moment and is used widely by investors and analysts to get an idea of the total financial health of your company. For most businesses, balance sheets are prepared only at the end of each month, quarter, and year.

Here’s an example from ExxonMobile via Investopedia

Why is Cash Flow King Queen?

The third model in your business toolbox is a cash flow analysis.

Your cash flow is a lot like your bank account. It shows all the inflows and outflows of cash.

Timing is everything. According to US Bank, a huge 82% of small businesses fail, not because of poor marketing or a bad product, but because of lack of cash.

Say you just completed a huge order for business A. You put all of your time into it, you hired support who you paid on the day, you bought lots of materials out of pocket. If you invoice promptly and have given your customer 21 days to pay, you could leave yourself unable to cover your utilities or rent until they deposit your money. You might have to turn down a big order for business B who needs fulfilment in two weeks.

If you had your incoming and outgoing money laid out in a cashflow analysis you could’ve foreseen that you’d be low on cash; you could’ve agreed 30-day terms with the freelancers you hired or brokered credit with your materials supplier.

Download a simple template to better understand your cash position.

When you’re first starting out, one of the most important things you’ll do for your cash flow is negotiate good terms of trade, so that you don’t have too many outgoings before you start bringing in money.

How can you improve cash flow?

- Invoice on time

- Promptly chase any debtors

- Negotiate with suppliers for longer payment terms

- Join up with another business for purchasing to get economies of scale

- Increase your prices

- Offer discounts for early payment to debtors

- Take out a loan or overdraft

Quick Look Business Finance Glossary

Break-even point

The point in time when your revenues exactly match your expenditures.

Capital expenditure (CAPEX)

The money you spend to generate benefits in the future. This long-term investment could be either a fixed asset, or something that adds value to your existing assets.

Depreciation

The loss of value in an asset because of wear and tear over time.

Equity

A measure of your company’s financial health by analysts. If your business’ assets were liquidated and your debt was all paid off, equity would be the remaining value.

Key performance indicator (KPI)

A term used to evaluate the success of your company or an activity, like a campaign or program. Companies use them as measurable objectives or a set of goals to reach.

Margin

Expressed as a percentage, your profit margin tells you the degree to which your company or a business activity makes money, by dividing income by revenues. For example, a gross profit of $10k on sales of $100k is a 10% profit margin. Companies can compare profit margins with others to see how they are doing.

Market segmentation

Market segments are groups of consumers that share the same characteristics like age, gender, or religion, usually resulting in the demand for similar products or services.

Negative equity

When your total borrowing or payment for your assets exceed their value.

Price elasticity of demand (PED)

A number expressing a change in demand for a product in relation to its change in price.

Return on investment

A ratio of net income to operating cost used to measure any activity or asset. It tells your company the strength of the activity’s earning power, and whether it’s profitable enough to continue doing.

Share options

An option that allows employees the option to buy ordinary shares at a lower price at a future date, in addition to their regular salary, if they meet their performance objectives.

Stakeholders

Anyone who has an interest in or is affected by a business or its activities. It includes everyone, from your shareholders to your customers, to people who live in your neighborhood.

Turnover

The total sales of your business or company during a specified time period.

Sign Up For Our Newsletter